The Ides of March are behind us, but the Ides of April await – aka Tax Day.

The first attempt to tax income in the US occurred in 1643, when several colonies instituted a "faculties and abilities" tax. Early tax collectors went door to door, asking if the individual had income during the year. If so, the tax was computed on the spot. This income tax came on top of the existing property taxation and raised little revenue.

In the early 18th century and well into the 19th century, several southern colonies and states adopted an income tax modeled on the tax instituted in England which taxed the income from property, and not the property itself. As a result, sales of property were not subject to taxation.

Throughout history, governments have used taxes to finance wars. The US was no different and imposed its first personal income tax in 1861 to pay for the Civil War. Tax rates were 3% on income exceeding $600 and less than $10,000, and 5% on income exceeding $10,000.

Congress passed the Wilson-Gorman Tariff in 1894, introducing the first peacetime income tax, notably without the signature of then-President Grover Cleveland. The rate was 2% on income over $4000, which meant fewer than 10% of households would pay anything.

In 1895, Charles Pollock challenged the legality of income taxes when he sued Farmers' Loan and Trust, a corporation in which he owned stock, arguing that Farmers' should never have paid the income tax because the tax on income from land. In a 5–4 decision, the Court ruled that the unapportioned income tax on income from land was unconstitutional. On May 20, 1895, the Court expanded its holding to rule that the unapportioned income tax on income from personal property (such as interest income and dividend income) was also unconstitutional.

In response to the Supreme Court decision in the Pollock case, Congress proposed the Sixteenth Amendment, which was ratified in 1913, and states: "The Congress shall have the power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration." The new tax was set at 1% tax on net personal incomes above $3,000, with a 6% surtax on incomes above $500,000.

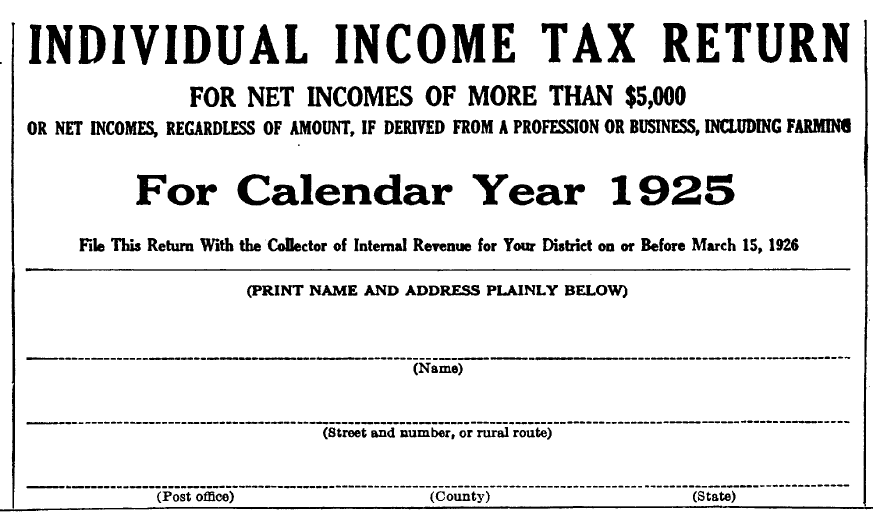

By 1918, the top rate of the income tax increased to 77% on income over $1,000,000 (equivalent to $16,717,815 in 2018 dollars) to finance WWI. The average rate for the rich, however, was 15%. The top marginal tax rate fell to 58% in 1922, to 25% in 1925 and finally to 24% in 1929. In 1932 the top rate increased to 63% during the Great Depression and steadily increased, reaching 94% in 1944 on income over $200,000 (equivalent of $2,868,625 in 2018 dollars).

Throughout the 1920s, the rates for single and married filing separately, married filing jointly, and head of household were all the same. In 1925, Form 1040 listed 24 income brackets based solely on income and ranging from 4% for those earning $4,000 ($68,763 today) to 46% for those earning $500,000 ($8,595,428 today).